Child Tax Credit 2024 Schedule 1 – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . Under the proposed legislation, the child tax credit would increase the maximum refundable child tax credit to $1,800 for 2023 tax returns, $1,900 for the following year, and $2,000 for 2025 tax .

Child Tax Credit 2024 Schedule 1

Source : kvguruji.com

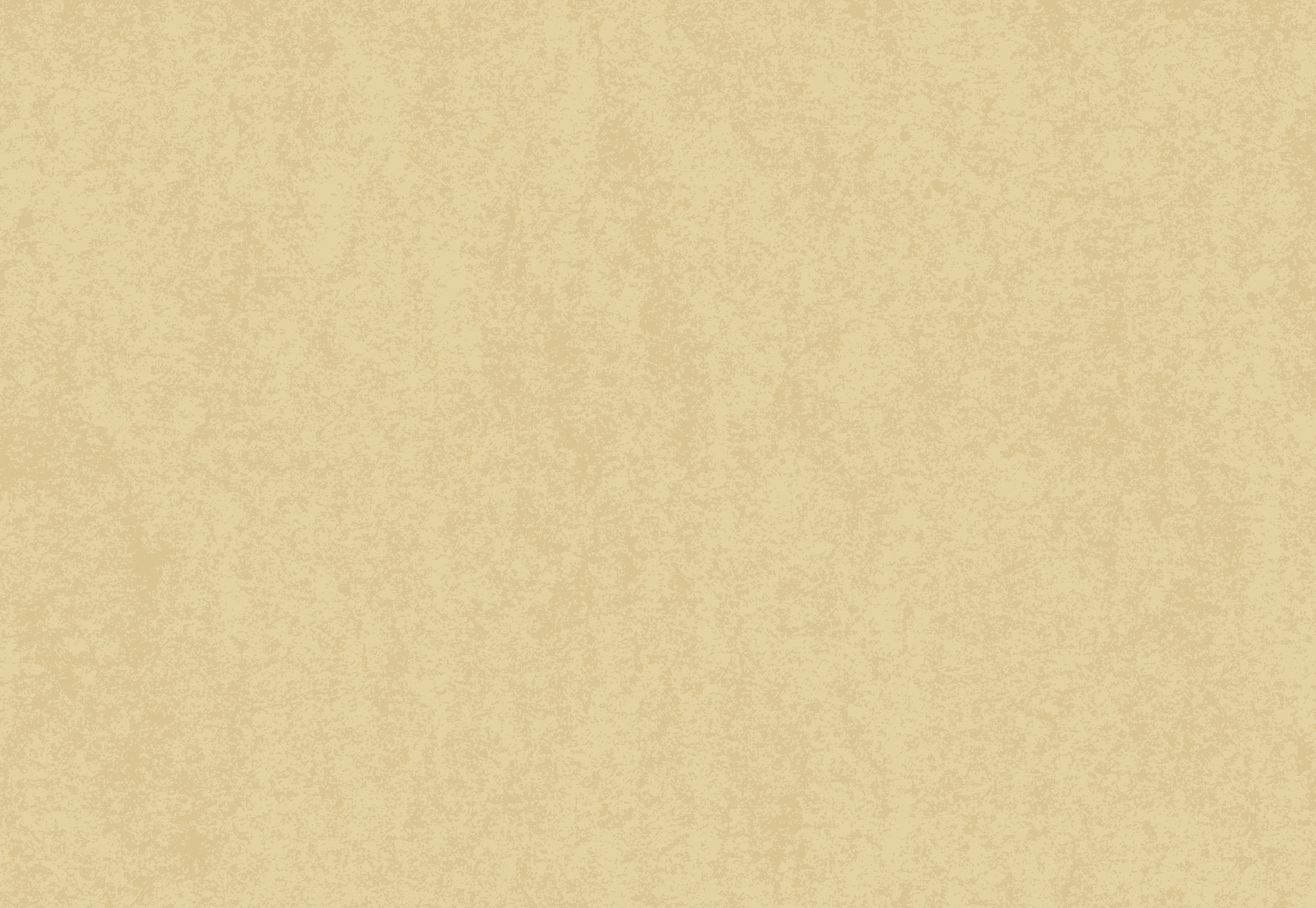

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child tax credit expansion, business incentives combined in new

Source : www.virginiamercury.com

Child tax credit expansion, business incentives combined in new

Source : georgiarecorder.com

Child tax credit expansion, business incentives combined in new

Source : iowacapitaldispatch.com

Child tax credit expansion, business incentives combined in new

Source : lailluminator.com

Child tax credit expansion, business incentives combined in new

Source : minnesotareformer.com

Buffalo Federation of Neighborhood Centers, Inc. | Buffalo NY

Source : www.facebook.com

Colorado Childcare Contribution Credit Workgroup Unveils Pla

Source : stimuluscheckupdates.com

CT Voices for Children on X: “Happy New Year! Want to know our

Source : twitter.com

Child Tax Credit 2024 Schedule 1 IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return: For the 2024 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible taxpayers could receive an additional $100 . Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child Tax Credit by October 2024 with a tax extension. A claimant must also fill out Schedule 8812 .